Oakland Nj Property Tax Rate . The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. property tax rates in new jersey will vary depending on the county and municipality. nj county property taxes. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. Below you will find a complete list of town. When combined with relatively high statewide. Although this bill is an estimate, it must.

from www.spur.org

the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. Below you will find a complete list of town. Although this bill is an estimate, it must. nj county property taxes. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. When combined with relatively high statewide. property tax rates in new jersey will vary depending on the county and municipality. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate.

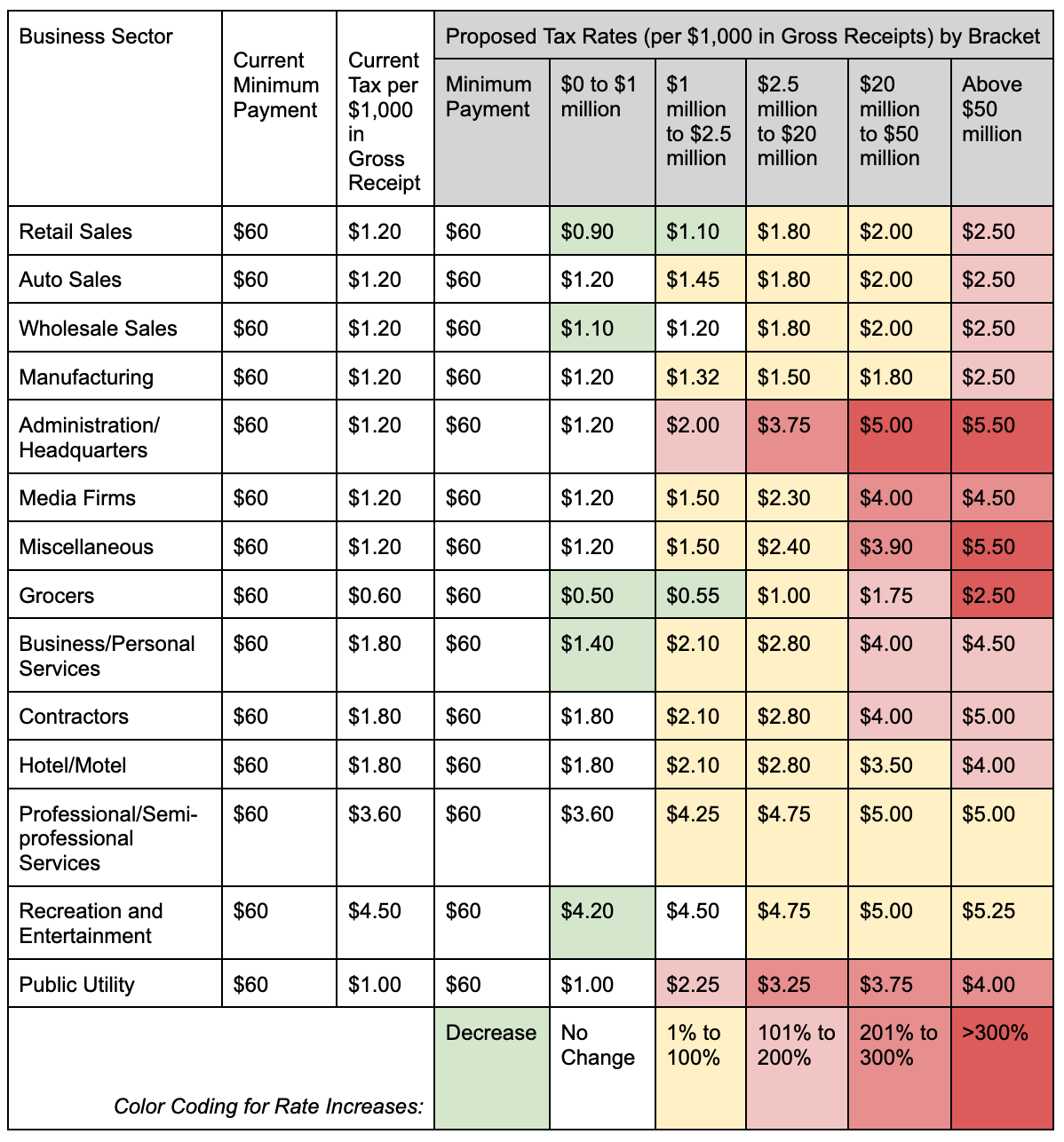

Oakland Measure T Progressive Business Tax SPUR

Oakland Nj Property Tax Rate the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. Although this bill is an estimate, it must. property tax rates in new jersey will vary depending on the county and municipality. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. When combined with relatively high statewide. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. nj county property taxes. Below you will find a complete list of town. The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate.

From www.pinterest.com

NJ's high property taxes keep rising — average now 8,953 Check out Oakland Nj Property Tax Rate When combined with relatively high statewide. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. Below you will find a complete list of town. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. the borough of oakland is issuing. Oakland Nj Property Tax Rate.

From bergencountyrealestate.soldbyvj.com

Bergen County, NJ Property Tax Rates 2019 to 2020 (201) 455SELL Oakland Nj Property Tax Rate the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. Below you will find a complete list of town. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. The tax assessment office is responsible for establishing and maintaining the assessed value for all real. Oakland Nj Property Tax Rate.

From www.northjersey.com

NJ property taxes Should homeowners prepay 2018 taxes? Oakland Nj Property Tax Rate The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. nj. Oakland Nj Property Tax Rate.

From wfpg.com

9 Towns With Cheapest Property Taxes In South Jersey Oakland Nj Property Tax Rate The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. Below you will find a complete list of town. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. property tax rates in new jersey will vary depending on the county and municipality. When combined with. Oakland Nj Property Tax Rate.

From nj1015.com

Bold plan to significantly reduce NJ property taxes Oakland Nj Property Tax Rate during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. nj county property taxes. The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. Although this bill is an estimate, it must. Below you will find a complete list of town. the. Oakland Nj Property Tax Rate.

From nj1015.com

Lowest property tax rate in NJ is in a town you’ve never heard of Oakland Nj Property Tax Rate Although this bill is an estimate, it must. The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. property tax rates in new jersey will vary depending on the county and municipality. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. Web. Oakland Nj Property Tax Rate.

From www.app.com

New Jersey property taxes highest in US Oakland Nj Property Tax Rate When combined with relatively high statewide. Although this bill is an estimate, it must. nj county property taxes. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the.. Oakland Nj Property Tax Rate.

From www.njspotlightnews.org

NJ property taxes have been rising at a slower pace NJ Spotlight News Oakland Nj Property Tax Rate during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. the average. Oakland Nj Property Tax Rate.

From www.gtgcustomhomebuilders.com

Property Taxes in New Jersey [And Why it Matters] Oakland Nj Property Tax Rate When combined with relatively high statewide. Below you will find a complete list of town. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. Although this bill is an estimate, it must. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022. Oakland Nj Property Tax Rate.

From ladyarisandi.blogspot.com

33+ how to calculate nj property tax LadyArisandi Oakland Nj Property Tax Rate The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. When combined with relatively high statewide. Below you will find a complete list of town. Although this bill is an estimate, it must. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. Web. Oakland Nj Property Tax Rate.

From www.youtube.com

Millions could receive property tax relief in New Jersey YouTube Oakland Nj Property Tax Rate property tax rates in new jersey will vary depending on the county and municipality. When combined with relatively high statewide. Below you will find a complete list of town. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. the borough of oakland is issuing tax bills for 3rd. Oakland Nj Property Tax Rate.

From bekinsmovingservices.com

Alameda County Property Tax 🎯 2024 Ultimate Guide to Alameda County Oakland Nj Property Tax Rate the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. Although this bill is an estimate, it must. Below you will find a complete list of town. during. Oakland Nj Property Tax Rate.

From propertyownersalliance.org

How High Are Property Taxes in Your State? American Property Owners Oakland Nj Property Tax Rate the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. Below you will find a complete list of town. property tax rates in new jersey will vary depending on the county and municipality. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger. Oakland Nj Property Tax Rate.

From danieljmitchell.wordpress.com

BluetoRed Migration, Part III The SlowMotion Suicide of HighTax Oakland Nj Property Tax Rate When combined with relatively high statewide. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. property tax rates in new jersey will vary depending on the county and municipality. nj county property taxes. Below. Oakland Nj Property Tax Rate.

From glassnercarltonfinancial.com

New Jersey Property Taxes OUCH! Oakland Nj Property Tax Rate nj county property taxes. The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. When combined with relatively high statewide. Although this bill is an estimate, it must. during 2021, 100% of all properties were. Oakland Nj Property Tax Rate.

From www.pinterest.com

New Jersey Property Taxes 2015 Average taxes by town New jersey Oakland Nj Property Tax Rate the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. nj county property taxes. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger. Oakland Nj Property Tax Rate.

From www.nj.com

Editorial New Jersey property tax penalty system allows municipalities Oakland Nj Property Tax Rate the median property value in oakland, nj was $535,900 in 2022, which is 1.9 times larger than the national average of. the average effective property tax rate in new jersey is 2.26%, compared with a national average of 0.99%. Although this bill is an estimate, it must. When combined with relatively high statewide. property tax rates in. Oakland Nj Property Tax Rate.

From infogram.com

North Jersey property taxes Infogram Oakland Nj Property Tax Rate the borough of oakland is issuing tax bills for 3rd quarter (august) 2024 property taxes. The tax assessment office is responsible for establishing and maintaining the assessed value for all real estate. during 2021, 100% of all properties were inspected to establish the new assessments for tax year 2022 (the. the median property value in oakland, nj. Oakland Nj Property Tax Rate.